Introduction

Navigating the investment world can feel a bit like trying to find your way through a dense forest — confusing paths, lots of options, and everyone giving different directions. Two of the most common routes investors explore in this journey are mutual funds and portfolio management services (PMS). Both aim to grow your money, both are managed by professionals, and both offer unique benefits. But they serve very different investor profiles, and choosing the wrong one could be like showing up for a marathon in hiking boots.

So, how do you know what’s right for you? This detailed guide breaks down the differences, pros, cons, and ideal use-cases for mutual funds and PMS. Whether you’re a beginner or a seasoned investor, this comparison will help you make an informed decision tailored to your financial goals and risk appetite.

What are Mutual Funds?

Mutual funds are collective investment schemes that pool money from multiple investors and invest that capital in various financial instruments like equities, bonds, and other securities. These funds are managed by professional fund managers employed by asset management companies (AMCs).

The idea is simple: you buy units of a mutual fund, and your money gets invested along with thousands of others in a well-diversified portfolio. The value of your investment rises or falls depending on the performance of the underlying assets. Since the investment is spread out across many stocks or bonds, the risk is also diversified, which is why mutual funds are often recommended for beginners or risk-averse investors.

One of the standout features of mutual funds is their accessibility. You can start investing with as little as ₹500 through SIPs (Systematic Investment Plans), making them ideal for small and medium investors. Plus, they’re regulated by SEBI (Securities and Exchange Board of India), which adds a layer of security and transparency.

Returns are typically linked to market performance, and while they aren’t guaranteed, the long-term track record of many funds shows healthy appreciation. You don’t need to be a stock market expert; the fund manager does the heavy lifting, making mutual funds an excellent passive investment tool.

Types of Mutual Funds

Equity Mutual Funds

These funds invest primarily in stocks of publicly listed companies. They carry higher risk but also offer the potential for higher returns over the long term. Equity funds are best suited for investors with a high-risk tolerance and long-term financial goals, such as retirement planning or wealth accumulation.

Debt Mutual Funds

These are focused on fixed-income securities like government bonds, corporate debentures, and money market instruments. They’re less volatile than equity funds and provide steady, though usually lower, returns. Ideal for conservative investors or those with short to medium-term goals.

Hybrid Funds

Also known as balanced funds, these invest in a mix of equities and debts, striking a balance between risk and reward. They’re suitable for investors seeking moderate growth with some risk mitigation.

Key Features of Mutual Funds

Professional Management

When you invest in a mutual fund, you’re essentially hiring a financial expert to manage your money. Fund managers analyse markets, pick stocks or bonds, and make investment decisions to maximise returns. You don’t need to track markets daily or worry about technical analysis.

Liquidity

Mutual funds, especially open-ended ones, offer high liquidity. You can redeem your investment partially or fully at any time (except for ELSS funds, which have a lock-in). This makes mutual funds flexible and accessible.

Diversification

Even with a small amount, your money is spread across a wide range of assets. This diversification reduces the impact of poor performance from a single stock or sector and helps manage risk efficiently.

What is Portfolio Management Service (PMS)?

PMS, or Portfolio Management Service, is a tailor-made investment solution where a professional portfolio manager manages your investments in equities and other securities on your behalf. Unlike mutual funds, where funds from various investors are pooled into a single portfolio, PMS accounts are individually managed and structured as per the investor’s specific goals, risk tolerance, and financial situation.

Typically offered to High Net-Worth Individuals (HNIs), PMS requires a minimum investment of ₹50 lakhs in India. The service comes with a high degree of customisation, offering a more focused, hands-on approach to wealth creation. The investor owns all the stocks or securities directly, unlike in mutual funds where you own units of the fund.

PMS can be more dynamic in terms of strategy. Managers can buy or sell specific securities without the limitations mutual fund managers often face. There’s also more transparency since you can view exactly what your portfolio holds and track each security’s performance in real-time. That said, it’s also a higher-risk, higher-reward scenario and demands a greater understanding or trust in the fund manager’s capabilities.

While PMS is regulated by SEBI, it does come with fewer constraints, giving the fund manager more autonomy — but also requiring the investor to be more vigilant and involved in understanding their strategy.

Types of Portfolio Management Services

Discretionary PMS

In this format, the portfolio manager has full control over investment decisions. They select securities, decide entry and exit points, and rebalance portfolios without needing the client’s approval for each move. Most investors choose this for convenience and trust in the manager’s expertise.

Non-Discretionary PMS

Here, the manager acts more like an advisor. They suggest investment strategies and stock picks, but the final call rests with the investor. It’s suitable for those who want expert guidance but still prefer to retain decision-making control.

Advisory PMS

In advisory PMS, the manager offers recommendations and a complete financial plan, but execution is the client’s responsibility. It suits sophisticated investors who can execute trades on their own, often used by ultra-HNIs with in-house teams.

Key Features of PMS

1. Customisation

Unlike mutual funds, PMS isn’t a one-size-fits-all model. Each portfolio is crafted based on the investor’s preferences — be it growth-oriented, income-focused, sector-specific, or conservative. This level of personalisation ensures alignment with the investor’s unique financial objectives.

2. Dedicated Fund Manager

A significant advantage of PMS is the access to a dedicated manager who oversees your investments and strategy. This individualised attention ensures that changes in market dynamics or your personal financial situation can be quickly accommodated.

3. Direct Ownership of Securities

You hold the stocks and securities in your name. This direct ownership provides greater transparency and control, allowing you to benefit from corporate actions such as dividends, rights issues, and voting rights.

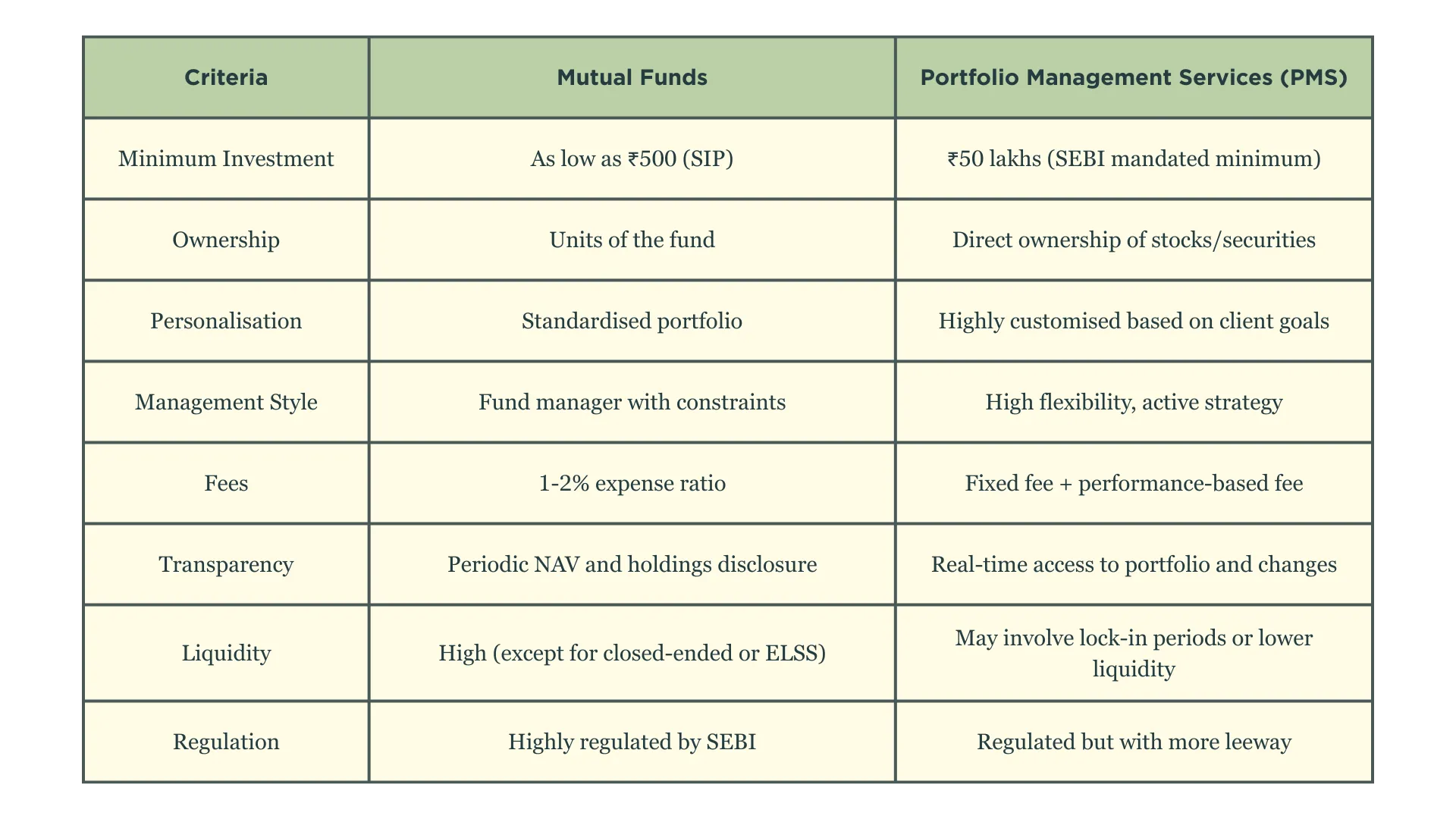

4. Comparing Mutual Funds and PMS

Choosing between mutual funds and PMS is not just a matter of returns — it’s about structure, access, risk, and goals. Here’s a detailed comparison:

This comparison shows that mutual funds are ideal for retail investors seeking simplicity and automation, while PMS suits those looking for tailored strategies and are comfortable with higher capital exposure and risk.

Tax Implications

Taxation of Mutual Funds

- Equity Mutual Funds: Gains held for more than one year are considered long-term and taxed at 10% for gains exceeding ₹1 lakh.

- Debt Funds: Short-term gains (less than 3 years) are taxed as per your income slab. Long-term gains (over 3 years) are taxed at 20% with indexation benefits.

- Dividend Income: Taxed in the hands of the investor as per their income slab.

Taxation under PMS

Taxation in PMS is more direct and individualised since the investor owns the securities. Each transaction — buying or selling — triggers a tax event:

- Short-Term Capital Gains (STCG) on listed shares are taxed at 15%.

- Long-Term Capital Gains (LTCG) above ₹1 lakh are taxed at 10%.

- Unlike mutual funds, PMS doesn’t pool gains; each trade affects your tax liability.

Which is More Tax-Efficient?

Mutual funds generally offer more tax efficiency for average investors due to fewer trades and pooled treatment of gains. PMS, while potentially more rewarding, can lead to a higher tax burden due to frequent transactions and direct capital gain applicability.

Who Should Choose Mutual Funds?

Mutual funds are often hailed as the “common man’s” investment vehicle — and for good reason. They offer simplicity, diversification, and professional management at a low entry point. But who exactly should go for mutual funds over PMS?

Ideal Investor Profiles

- First-time Investors: If you’re new to investing and not entirely comfortable making stock picks on your own, mutual funds are the perfect place to start.

- Small to Medium Investors: Those with limited investable surplus (under ₹50 lakhs) will find mutual funds accessible and flexible.

- Passive Investors: If you’d rather not worry about daily market fluctuations and prefer a hands-off approach, mutual funds handle the complexities for you.

Goals and Time Horizons

Mutual funds suit a variety of goals — whether it’s building an emergency corpus, saving for a down payment, funding a child’s education, or planning retirement. They’re structured for both short-term liquidity and long-term wealth accumulation, depending on the fund type chosen.

Moreover, Systematic Investment Plans (SIPs) make investing consistent and disciplined. You can invest monthly, watch your capital grow with compounding, and gradually build wealth over time.

Risk Tolerance

Mutual funds offer different options for all kinds of risk profiles. If you’re risk-averse, go for debt funds. If you’re moderately risk-tolerant, hybrid funds are ideal. For aggressive investors seeking higher returns, equity funds do the job.

In essence, mutual funds are for those who want to benefit from the market’s growth potential without the hassle of stock picking or the pressure of making active decisions daily.

Who Should Choose PMS?

PMS is not everyone’s cup of tea. It’s tailored for discerning investors who understand the nuances of market movements and are looking for something beyond what mutual funds can offer. Let’s dive into the type of investors PMS is best suited for.

High Net-Worth Individuals (HNIs)

SEBI mandates a minimum investment of ₹50 lakhs for PMS accounts. That alone sets the bar high and limits the audience to those with considerable disposable capital. HNIs and ultra-HNIs often prefer PMS due to the bespoke nature of services and focused strategies.

Those Seeking Personalised Strategies

If you want a portfolio built around specific sectors (like tech or healthcare), have tax considerations, or require capital preservation during volatile phases, PMS offers the level of control and customisation needed. You can even include ESG criteria or thematic investments as per your beliefs or objectives.

Active Investors

PMS gives you real-time access to your portfolio. You can track each stock’s performance and understand how strategies evolve based on market dynamics. This level of involvement is ideal for those who enjoy actively engaging with their wealth.

Entrepreneurs and Professionals

For those too busy to manage wealth actively but require personalised strategies to match fluctuating income or capital inflows, PMS offers a professional extension to your financial planning.

In summary, PMS is for experienced investors who are financially well-settled and want more from their money — personalisation, control, and potentially higher returns.

Pros and Cons of Mutual Funds

Mutual funds, while widely popular and beginner-friendly, do have their advantages and limitations.

Pros

- Low Entry Point: Start with as little as ₹500.

- Diversification: Spreads risk across multiple assets.

- Professional Management: Expert fund managers at the helm.

- Liquidity: Easy to redeem units anytime (except in locked-in funds).

- Regulated & Transparent: SEBI ensures fair practices.

- Flexibility: Choose between equity, debt, or hybrid based on goals.

Cons

- Limited Control: You can’t choose the specific stocks.

- One-Size-Fits-All: The portfolio is designed for all investors.

- Exit Loads and Expense Ratios: These reduce your net returns.

- Over-diversification: Sometimes returns get diluted due to excessive spread.

- Tax Efficiency May Vary: Especially in actively managed funds with high turnover.

Overall, mutual funds are ideal for simple, effective, and long-term investing but may not offer the customisation or control that some investors desire.

Pros and Cons of PMS

PMS brings personalisation and strategy into investing but isn’t without its caveats. Let’s weigh the good and the not-so-good.

Pros

- Customised Portfolio: Tailored to match your specific goals and risk tolerance.

- Direct Ownership: Full transparency and control over individual securities.

- Active Management: Frequent strategy updates and quicker decision-making.

- Higher Return Potential: Focused portfolios may outperform diversified mutual funds.

- Dedicated Manager: Personalised advice and regular portfolio reviews.

Cons

- High Minimum Investment: Entry barrier of ₹50 lakhs.

- Expensive: Charges include management fees + performance-linked fees.

- Tax Complexity: Higher frequency of trades increases capital gains.

- Lower Liquidity: Exit may not be as easy as mutual funds.

- Market-Linked Risk: High risk if not managed effectively.

PMS is best when you want hands-on wealth management and can afford to take on the added responsibility and risk that comes with a tailored portfolio.

Performance Comparison

Performance is often the deciding factor for investors. But comparing mutual funds and PMS purely on returns is like comparing apples and oranges. Still, let’s dissect some key performance trends.

Mutual Funds

- Historical Returns: Top-performing equity mutual funds have delivered 12–15% annualised returns over the last 5–10 years.

- Volatility: Managed through diversification. Sharp declines in one sector are usually offset by gains in another.

- Consistency: More stable across market cycles due to broader holdings.

- Performance Drivers: Depend on fund house strategy, AUM size, and manager skill.

PMS

- Higher Return Potential: Select PMS strategies have shown 18–22% returns, especially during bull markets.

- Focused Bets: Less diversification means sharper gains — and losses.

- Alpha Generation: PMS is known for generating alpha, i.e., returns over and above benchmarks.

- Volatility: Much higher. A focused bet can backfire just as quickly as it succeeds.

If you have the stomach for risk and access to top-tier fund managers, PMS can significantly outperform mutual funds. But with greater reward comes greater risk.

Factors to Consider Before Choosing

Choosing between mutual funds and PMS is not just about performance or accessibility — it’s about aligning your investment style with your financial landscape. Here are the key factors you must evaluate before deciding which option suits you better.

1. Risk Appetite

Are you someone who sleeps peacefully regardless of market fluctuations, or do you panic when your investment dips by even 5%?

- Low to Medium Risk Tolerance: Mutual funds, especially debt or hybrid ones, are safer and provide risk-adjusted returns.

- High Risk Tolerance: PMS is for investors who are comfortable with volatility and want to take calculated bets for higher returns.

2. Investment Horizon

Your time frame plays a big role:

- Short to Medium-Term Goals (1–5 years): Mutual funds, especially debt or balanced funds, are more suitable.

- Long-Term Goals (5+ years): PMS portfolios typically yield better results over a longer time frame due to compounding and active strategy implementation.

3. Capital Availability

This one’s a deal-breaker:

- Less than ₹50 lakhs: Mutual funds are your only regulated option.

- More than ₹50 lakhs: PMS becomes viable and worth considering.

4. Financial Knowledge & Involvement

- Beginner or Passive Investor: Mutual funds are simple, regulated, and require minimal attention.

- Experienced or Active Investor: PMS lets you interact with your portfolio, engage with your fund manager, and steer your investments actively.

5. Tax Position and Planning

- Tax Simplicity: Mutual funds are more tax-efficient, especially with SIPs and fewer transactions.

- Strategic Tax Planning: PMS gives you more control over when and how to realise gains or losses but can get complex.

6. Customisation Needs

- Generic Portfolio Fine: Mutual funds work well.

- Specific Needs or Sector Bets: PMS offers customisation that mutual funds can’t match.

By evaluating these factors carefully, you can choose the right investment vehicle that supports your wealth creation journey.

Conclusion

So, what’s right for you — mutual funds or portfolio management services?

If you’re just starting out, prefer a simple and accessible investment method, and want to grow your money passively, mutual funds are the clear winner. They’re low-cost, flexible, and require minimal effort, making them perfect for most retail investors.

On the other hand, if you’re a high-net-worth individual, looking for a bespoke strategy, and ready to actively engage with your investments, PMS could be your ticket to potentially superior returns. It offers deep customisation, direct control, and hands-on portfolio management — but also comes with higher costs and complexities.

Ultimately, the choice depends on your financial goals, risk appetite, investment amount, and preference for control. There’s no one-size-fits-all here. Many savvy investors even use both — mutual funds for core stability and PMS for tactical, high-growth opportunities.

Whatever you choose, ensure it aligns with your long-term vision, and remember — the best investment is the one that helps you sleep peacefully at night.